HVAC Rebates & Tax Credits

Federal Tax Credits

(Residential Clean Energy & Home Improvement)

Energy Efficient Home Improvement Credit: Claim 30% of costs (up to $3,200/year), including:

- Heat pumps, central ACs, furnaces, water heaters (up to $2,000/item)

- Insulation, windows, doors, audits (up to $1,200 total)

Residential Clean Energy Credit: Another 30% tax credit for solar, geothermal heat pumps, battery storage, etc., with no cap (until 2032)

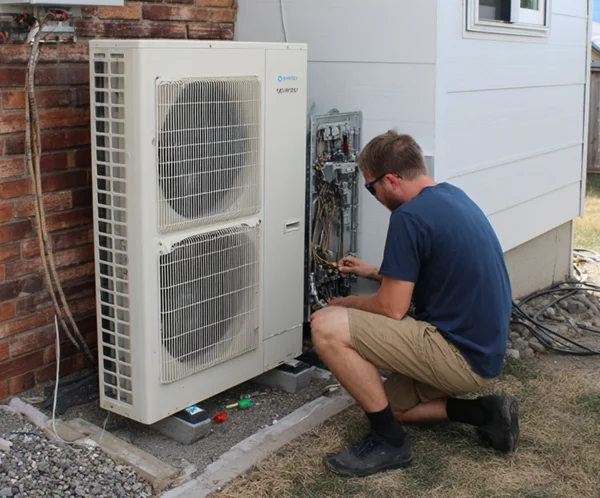

ENERGY STAR Air‑Source Heat Pumps: Installed between 2023–2032, qualify for up to $2,000 credit

Se If You Qualify

California-Specific Rebates

(HEEHRA / TECH Clean CA)

State rebates: Eligible homeowners in LA can receive up to $8,000 toward heat pump HVAC systems.

- Up to $8k for incomes ≤ 80% AMI

- Up to $4k for incomes between 80–150% AMI

TECH Clean California offers an additional $1,000 per system ($2,000 max) rebate

Local & Utility Rebates in Los Angeles

LA-area utilities may offer $100–$3,000 in additional HVAC Rebates & Tax Creditsr for homeowners installing efficient heat pumps

These incentives stack with federal and state credits—total potential savings can reach $10,000+ on high-efficiency systems.

How to Maximize Your Savings

Bundle upgrades strategically:

Example: Combine insulation ($1,200 cap) with a heat pump ($2,000 cap) to claim up to $3,200 in a single tax year.

Stack rebates:

Combine federal, state, and local incentives for maximum financial impact.

Ensure equipment qualifies:

Must be ENERGY STAR certified and meet Qualified Manufacturer (QM) standards with PIN listings on IRS Form 5695

Claiming Credits & Rebates

Federal:

File form IRS 5695, include the QM PIN from your heat pump/AC.

State & Local:

Apply through TECH Clean California and your local utility’s rebate programs (paperwork typically handled by contractors).

Timing:

Work must be completed and paid by December 31, 2025, to qualify under current rules

Summary of Potential Savings (Example)

| Upgrade | Federal Tax Credit | State Rebate | Utility Rebate | Total Savings |

|---|---|---|---|---|

| Heat Pump Installation | $2,000 | $8,000 | $1,500 | $11,500 |

| Insulation Upgrade | $1,200 | - | $500 | $1,700 |

| Total (~1 home project) | $3,200 | $8,000 | $2,000 | $13,200+ |

Next Steps

- Get an energy audit to identify eligible upgrades.

- Choose ENERGY STAR-certified HVAC or heat pump systems.

- Confirm rebate eligibility via your contractor, utility, and the TECH Clean portal.

- Keep receipts and documentation—submit with IRS Form 5695.

Bottom line: Los Angeles homeowners can tap into 30% federal tax credits, up to $8,000 in state rebates, and local utility incentives, leading to combined savings that often exceed the cost of installation. Contact our team to see if you qualify for HVAC Rebates & Tax Credits.

Book Now

Book Now

Menu

Menu